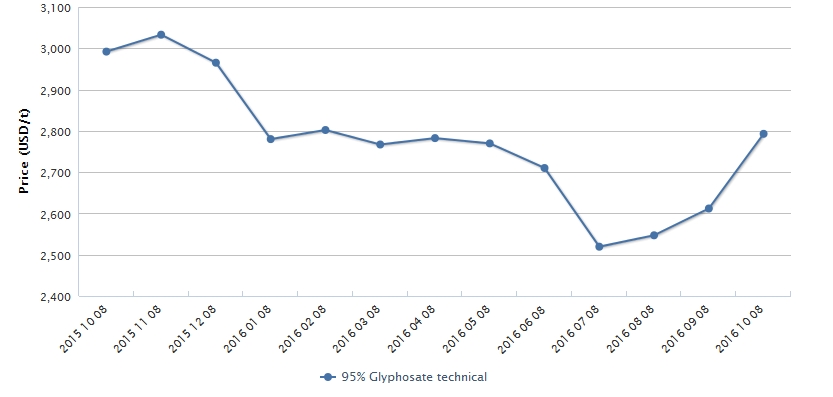

The ex-works price of glyphosate 95% TC

averaged USD2,793/t in mid-Oct. 2016, a raise of 9.85% over the USD2,519/t of

mid-July, which is the biggest rebound since when the glyphosate industry

remained depressed for two years. What’s driving the price rise and how long

will it last? Analyst CCM has the

answers…

Source: Bing

After that Sichuan Fuhua Tongda

Agro-chemical Technology Co., Ltd., a leading glyphosate enterprise in China,

raised its glyphosate price at the end of Aug. 2016, several other glyphosate

enterprises followed the trend to increase the quotations of glyphosate.

According to CCM's price monitoring, in

mid-Oct. 2016, China's glyphosate price still showed a steady uptrend. The

ex-works price of glyphosate 95% TC averaged USD2,793/t, a raise of 9.85% over

the USD2,519/t of mid-July, which is considered the biggest rebound since when

the glyphosate industry remained depressed for two years. However, the price

was still low when compared with the same period last year.

Ex-works

price of glyphosate 95% TC in China, Oct. 2015-Oct. 2016

Source: CCM

What's the reason for this constantly

raising price of glyphosate and for how long will it keep raising? Chen Zaoqun,

chief editor of Herbicides

China News, gave her insights on the questions.

Peak

season for glyphosate

With the approaching of peak sale season

for glyphosate, all glyphosate enterprises in both upstream and downstream hope

to make impressive profits.

In fact, after experiencing market

depression for such a long time, many enterprises are at loss and are in an

urgent need of raising prices to relieve these losses.

"Some domestic glyphosate enterprises

have already received enquiries from the African market," disclosed an

industry insider to CCM.

Rising

costs of raw materials

Rising costs of raw materials in some way

support the increasing price for glyphosate. Currently, the prices of raw

materials for glyphosate, namely glycine, PMIDA etc. showed different degrees

of rises.

The quotation of glycine in East China

increased to USD1,313.28/t-USD1,343.12/t in mid-Oct. and the ex-works price was

about USD1,101/t, up 2.8% MoM.

As for PMIDA, in mid-Oct., both the

quotation and transaction price were up a little bit MoM, with the quotation of

USD1716.21/t-USD1790.83/t and the ex-works price of USD1,602/t, up 0.94% MoM.

In addition, on 21 Sept., the Management Regulations on Overloaded

Transportation Vehicle issued by China's Ministry of Transport and Ministry

of Public Security was implemented, the most significant regulation to tackle the

illegal overload in China.

“With the implementation of the new

regulation, it is possible to push up the transportation cost of bulk

commodities, which may affect the cost of the downstream products,” said Chen.

Price

support from environmental pressure

Affected by the 2016 G20 summit held in

Sept., glyphosate enterprises in Zhejiang Province and the surrounding areas

significantly reduced the operating rate, leading to a fall in the market

supply.

On 19 Sept., the 2016 Glyphosate

Collaborative Group Work Conference was held in Beijing, during which the first

draft of the Glyphosate Industry

Hazardous Wastes Disposal and Treatment Control Technical Specifications

(Outline) was explained and it revealed how the costs of waste water

disposal would further increase the production cost of glyphosate.

In addition, there are rumors that the

second batch of environmental inspection team will be stationed in major

glyphosate producing provinces including Sichuan and Hubei. When the time

comes, the production of enterprises within these areas may be affected, and

therefore market supply would be largely reduced.

“Environmental pressure from the Chinese

government helps increase the production cost of glyphosate while the

suspension on production in most of medium- and small-scale glyphosate

enterprises will hugely affect the supply of glyphosate, which it is a good

chance for the enterprises to rise their quotations,” stated Chen.

Glyphosate

price to keep rising?

As for whether the price of glyphosate will

keep rising in the short term, some industry insiders are still quite optimistic.

Thanks to the AgroChemEx 2016 held in Shanghai in 16-18 Oct., it is believed

that it would boost the transaction and price of glyphosate.

However, some insiders are doubtful on the

rising trend of glyphosate price.

Firstly, although glyphosate enterprises

are bearing environmental pressure, there are no new environmental policies

issued for the glyphosate industry, in other words, large glyphosate

enterprises still maintain high operating rate, and market supply won't be

greatly reduced.

Secondly, the price rises in Sept. boosted

the operating rate of some enterprises and increased market supply, which also

indicated that the price support in the coming future was lessened to some

extent.

Thirdly, according to CCM's research,

Jan.-July 2016 witnessed a YoY rise in China's export volume of glyphosate, but

the figure is likely to slide in Aug.-Dec., given the present slack in the

global demand.

“Whether the glyphosate price will increase

or fall mainly depends on the market. However, it is very likely that the price

will keep going with a small range of increase in short term,” added Chen.

Looking for more information on glyphosate

market in China? Want to monitor the price trend of glyphosate? CCM Online Platform is here to help you! An infinitive database, covering the whole agriculture industry

in China, gives you real-time access to CCM’s over 15-year data and

intelligence.

To get real-time news on glyphosate market

in China immediately, don’t hesitate! Get

your 7-day free trial NOW!